salt tax cap explained

California Approves SALT Cap Workaround. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

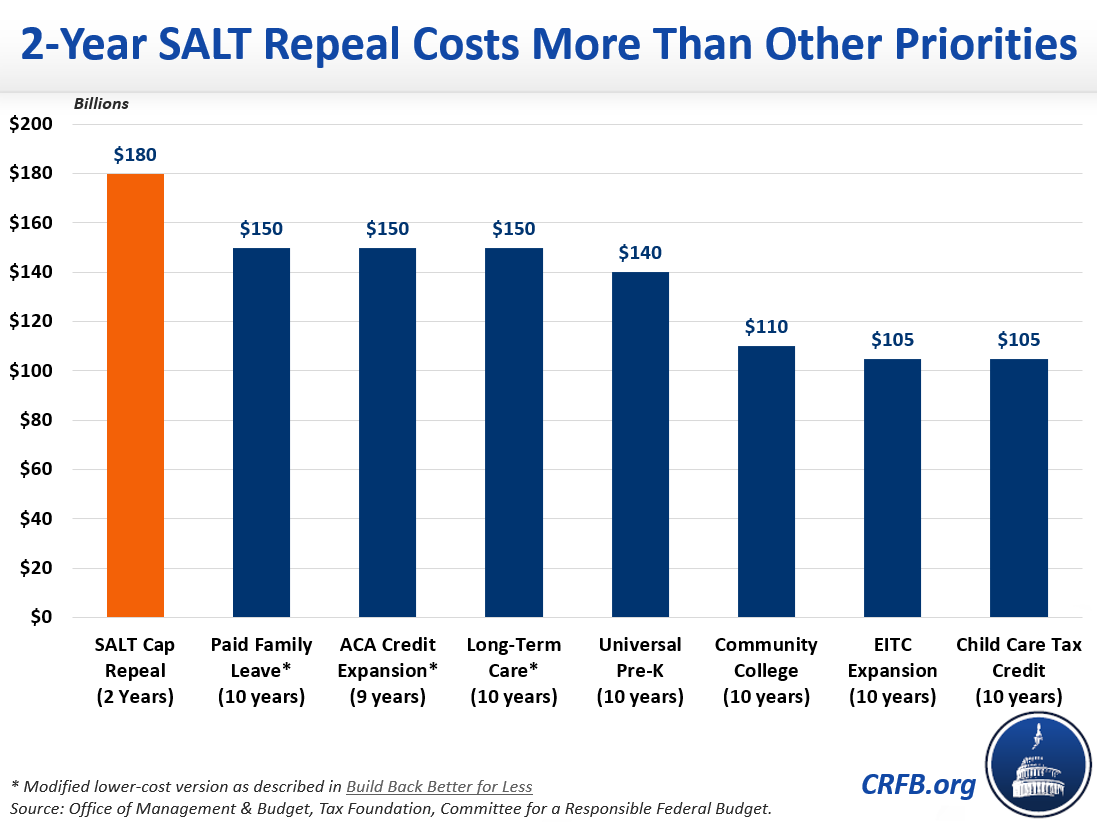

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

. 54 rows The Internal Revenue Service IRS has provided data on state and. To help pay for that increase SALT deductions were capped at 10 000 per. The deduction of state and local tax payments known as SALT from federal income taxes has been a subject of debate among economists and policymakers over the past few years with significant implications for our budget and fiscal outlook.

The House Republican tax plan would eliminate a federal tax deduction for. States and municipalities imposing entity-level taxes on PTEs are not new. Leaders are trying to decide whether to.

For taxpayers living in states with very high income tax rates taxpayers lose big time. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. 3 hours agoThe state and local tax deduction known as SALT was capped at 10000 under President Donald Trumps tax reform bill in 2017 in a move that Democrats decried as an attack on blue states like. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples filing separately.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. 2026 when the federal state tax limit is set to expire or if the state and local tax deduction cap is repealed before the expirationwhichever comes first. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont be.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1.

The federal tax reform law passed on Dec. While most states continue to conform to federal pass-through tax. The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes.

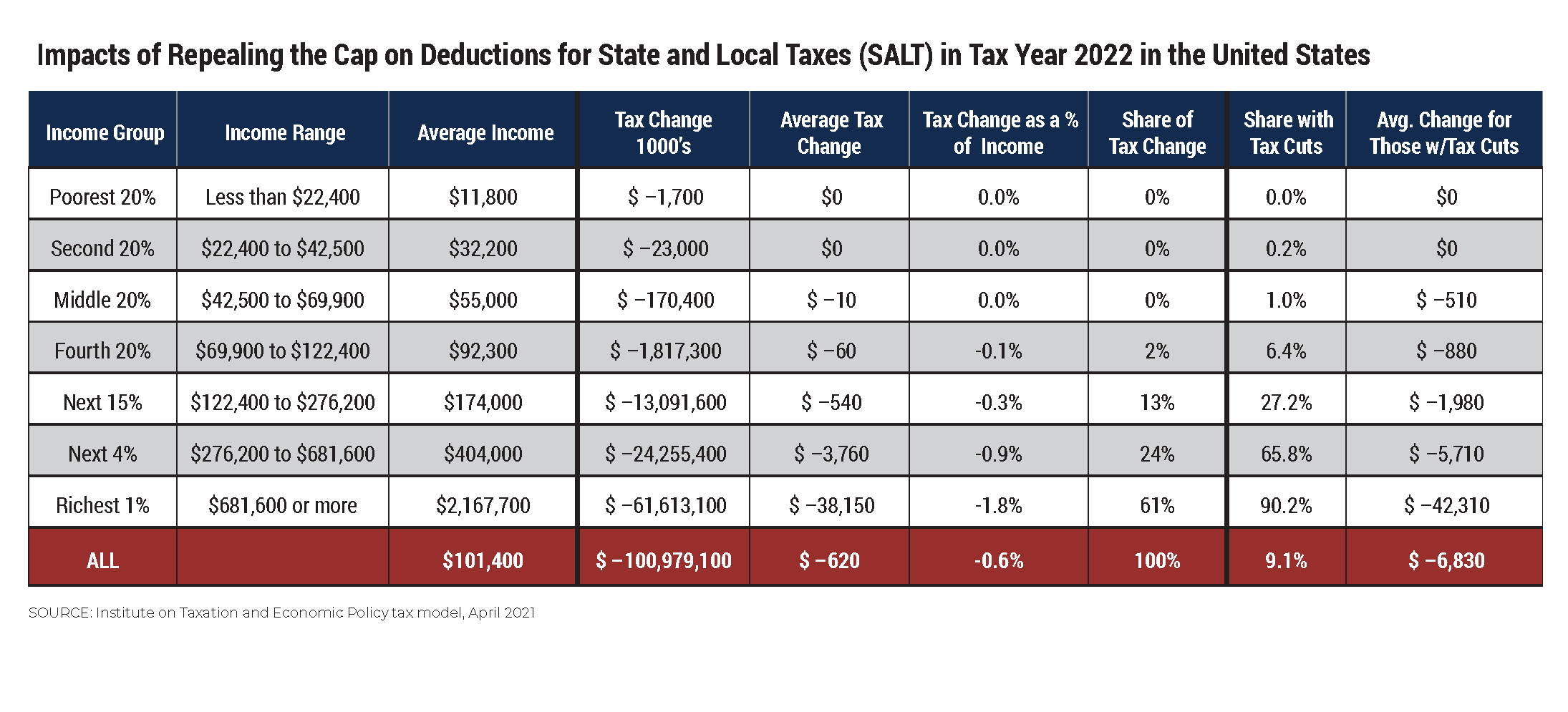

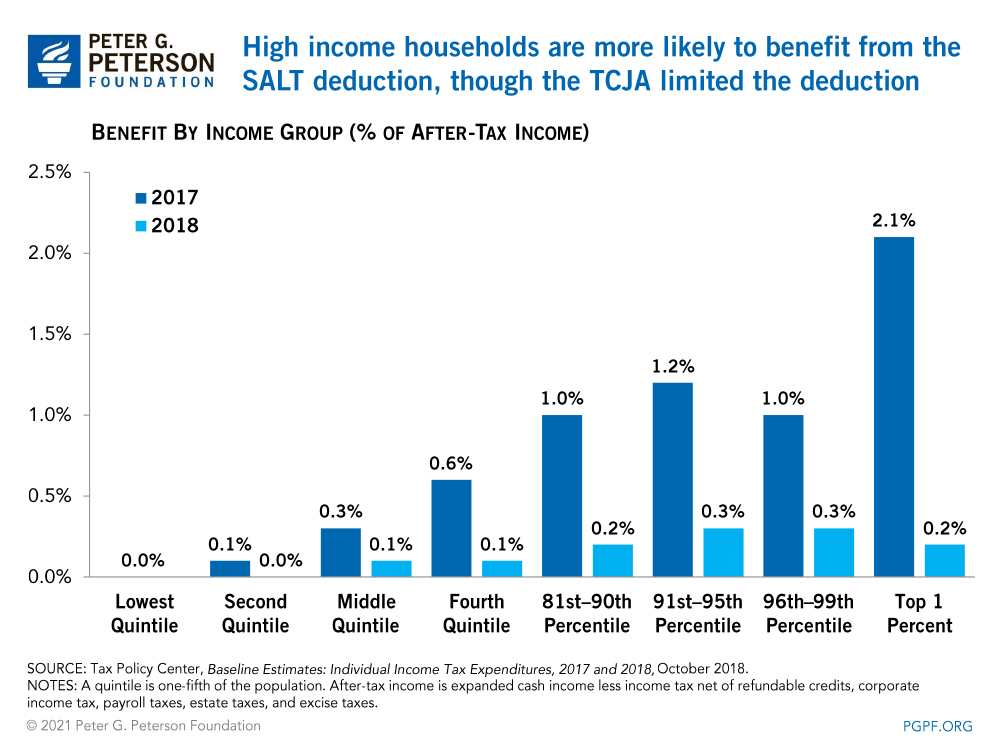

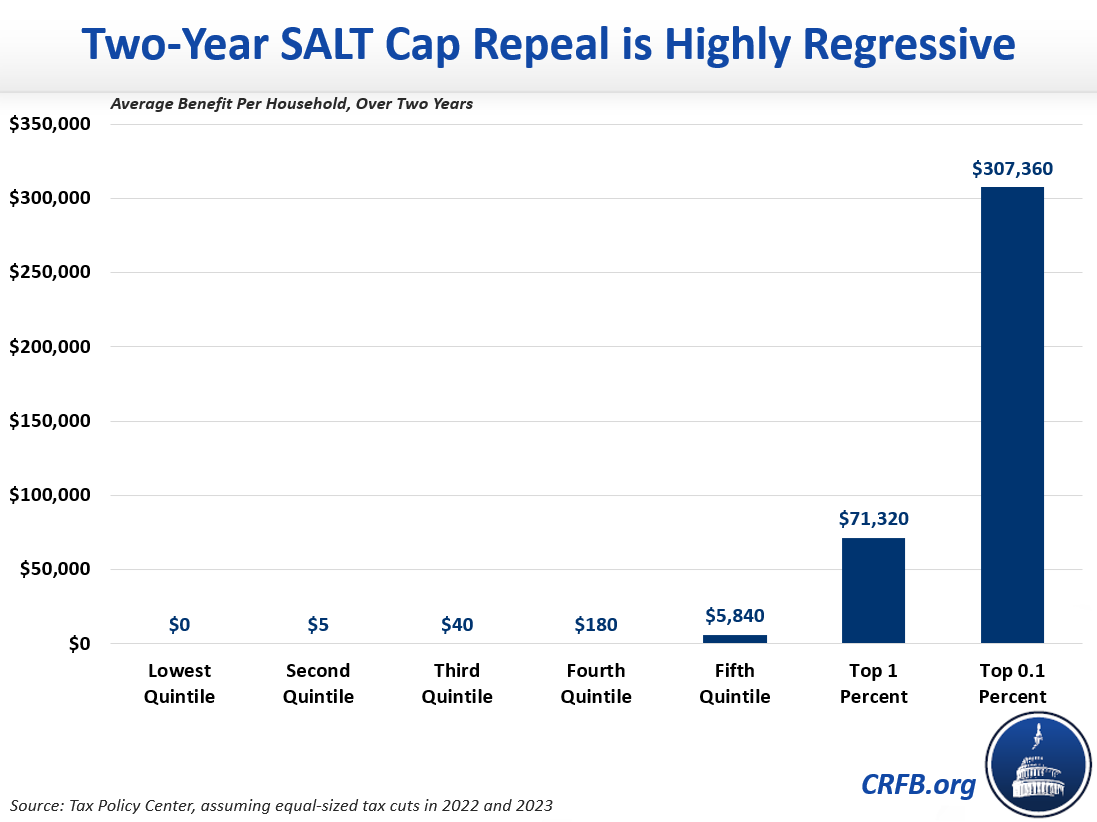

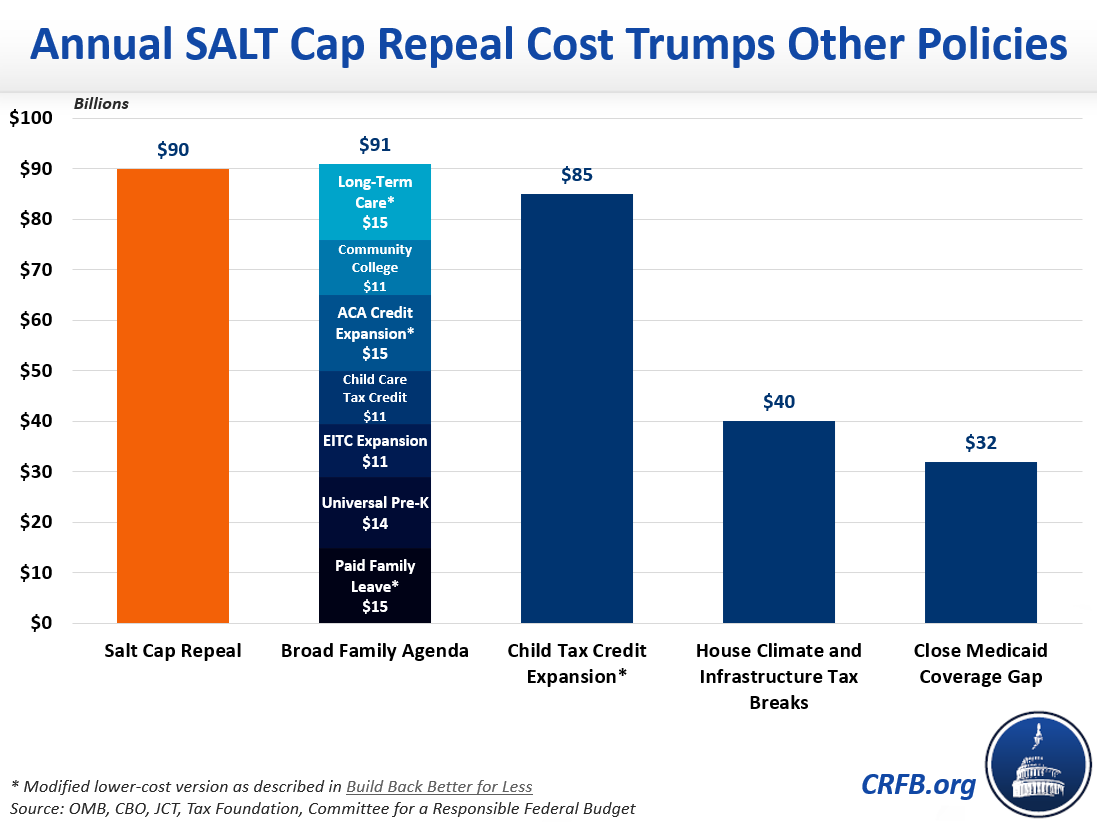

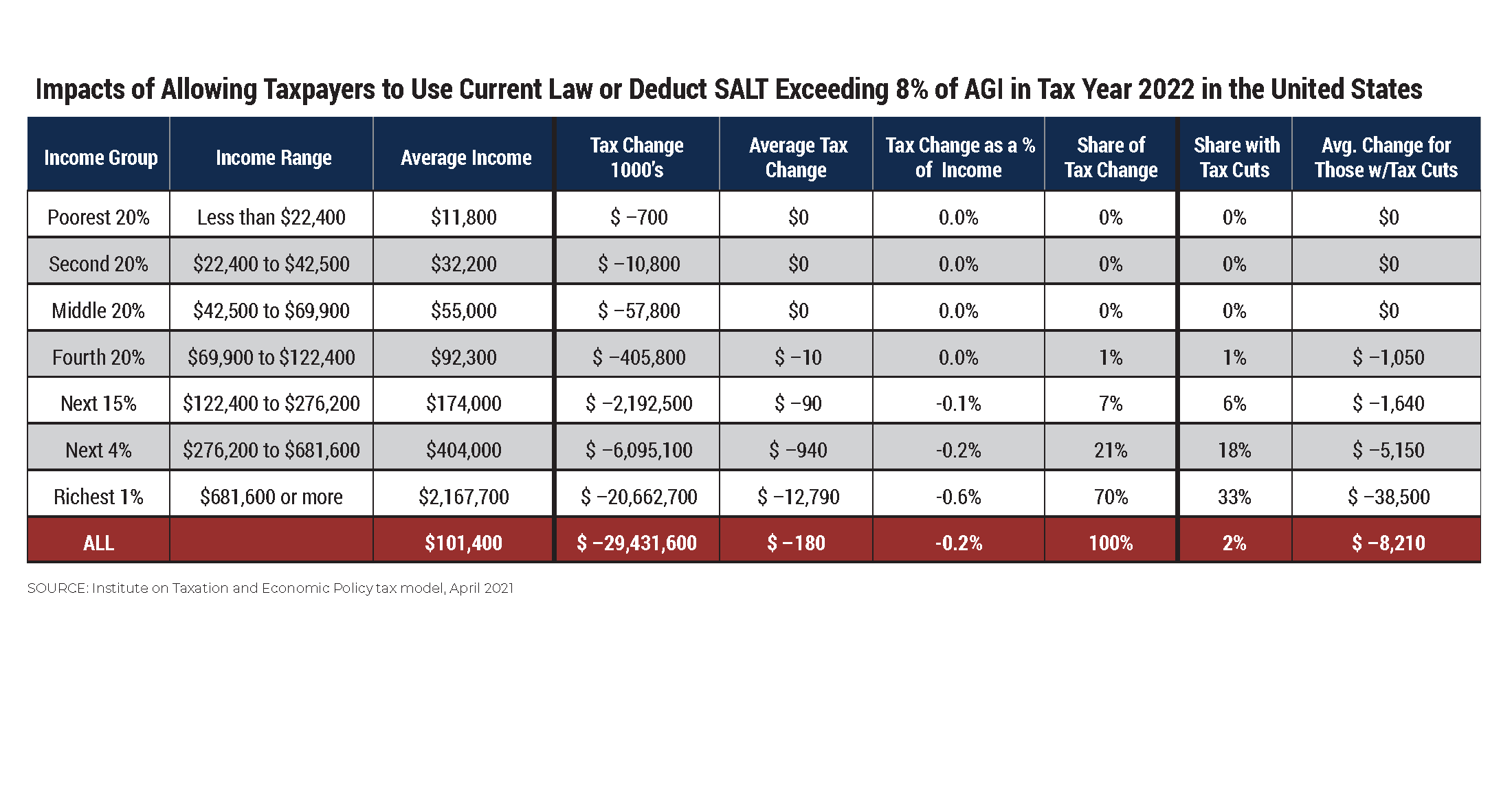

The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit. Unfortunately especially for higher income households the SALT deduction has been capped at 10000. It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages.

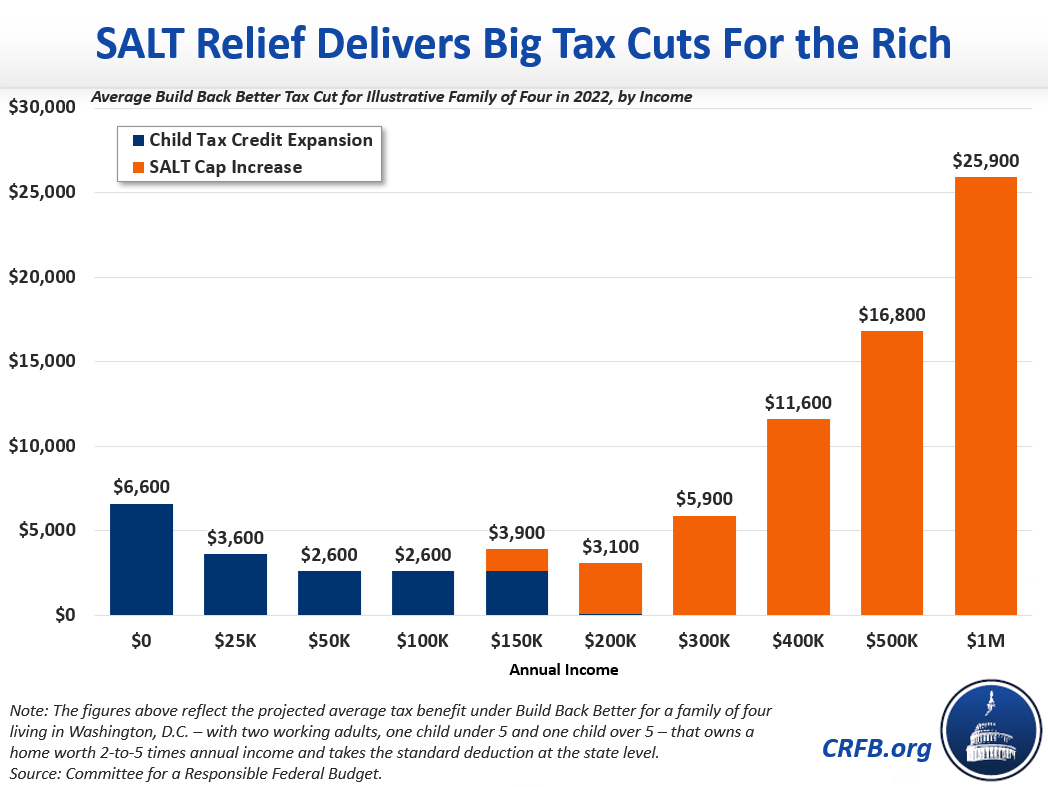

One obvious point of. Lifting the SALT cap much more pro-rich than Trumps tax bill. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are.

For tax years beginning between January 1 2021 and January 1 2022 the elective tax is due and payable on or before the due date of the tax. State and Local Tax SALT tax deduction cap explained. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. Now the SALT tax cap is set to expire in 2025. State Responses to the 10000 SALT Cap.

The District of Columbia New Hampshire New York City Tennessee and Texas have imposed mandatory entity-level income or franchise taxes on PTEs for years. There is talk that the SALT deduction limit will be increased from 10000 to 70000 as part of the Build Back Better Plan - this bill has not been signed into law. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire January 1 2032.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund.

In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. Because of the limit however the taxpayers SALT deduction is only 10000. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades.

The Tax Cuts and Jobs Act of 2017 TCJA imposed a 10000 cap on the itemized deduction for state and local taxes SALT from 2018 through 2025. Posted on November 9 2017 Updated on November 10 2017. However many filers dont know.

That limit applies to all the state and local. 52 rows The SALT deduction allows you to deduct your payments for. The Facts on the SALT Deduction.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

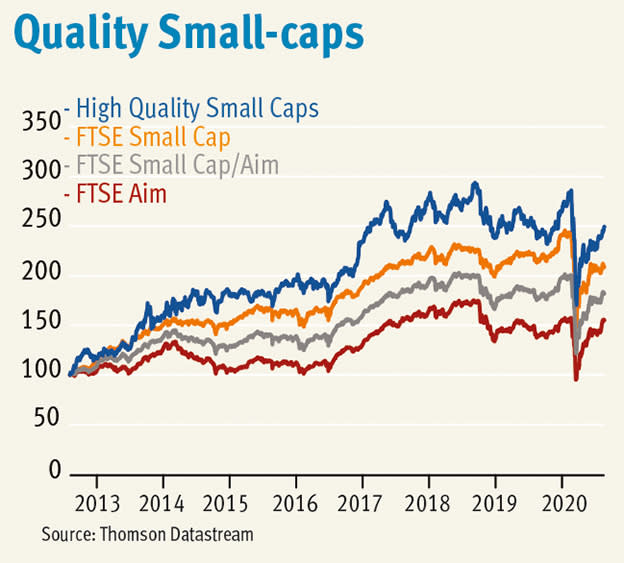

Fourteen High Quality Small Caps Investors Chronicle

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

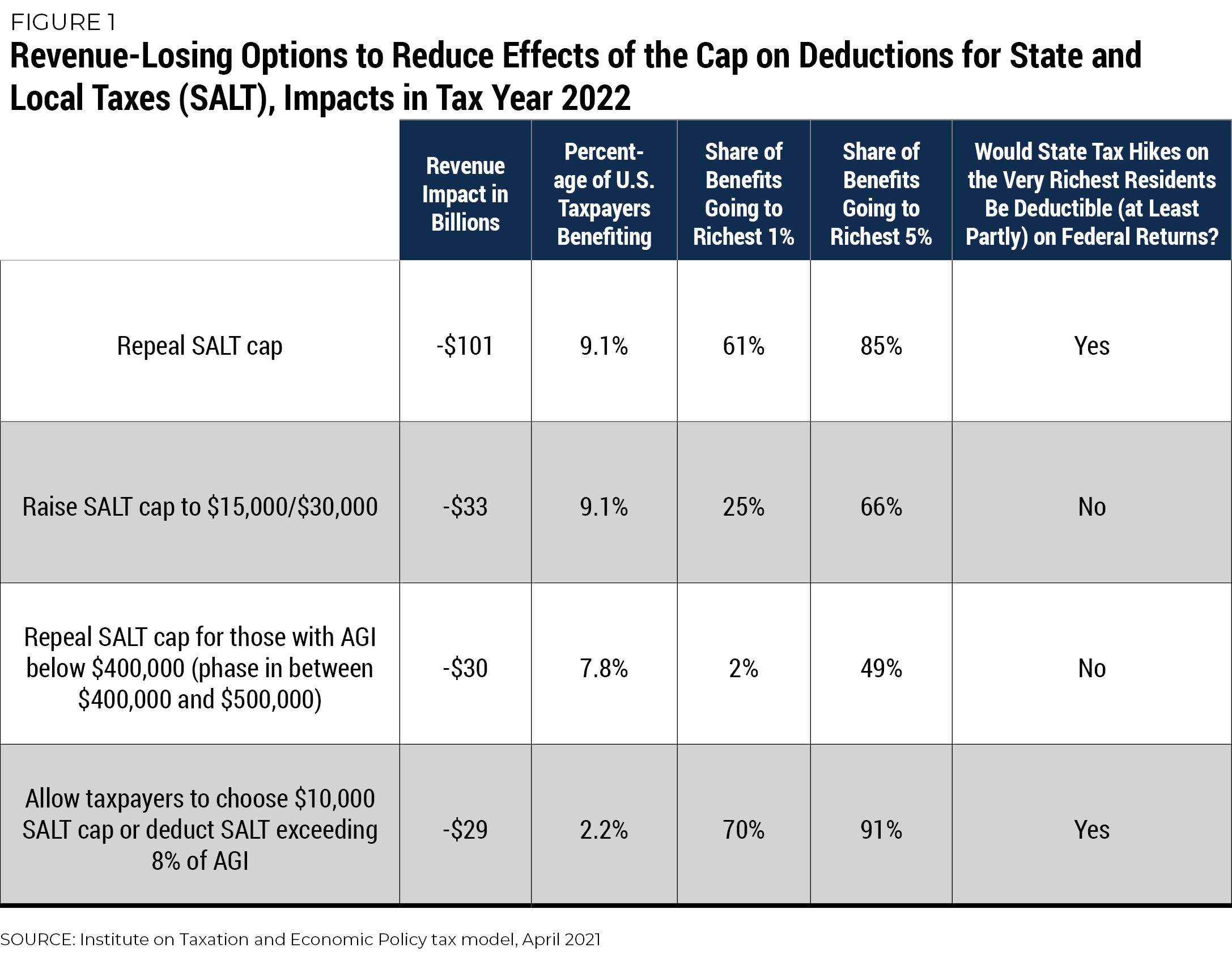

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

With Cap On Salt Deductions Lawmakers Consider Ways To Help Tax Payers Youtube

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Understanding Salt Cap Workarounds Youtube

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How To Deduct State And Local Taxes Above Salt Cap

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How High Are Capital Gains Taxes In Your State Tax Foundation

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget